Two Opportunity Zones Identified in the Clinton Region

The Opportunity Zones Program is a community development tool established by Congress in the Tax Cuts and Jobs Act (TCJA) of 2017 to encourage long-term investments in low-income urban and rural communities nationwide.

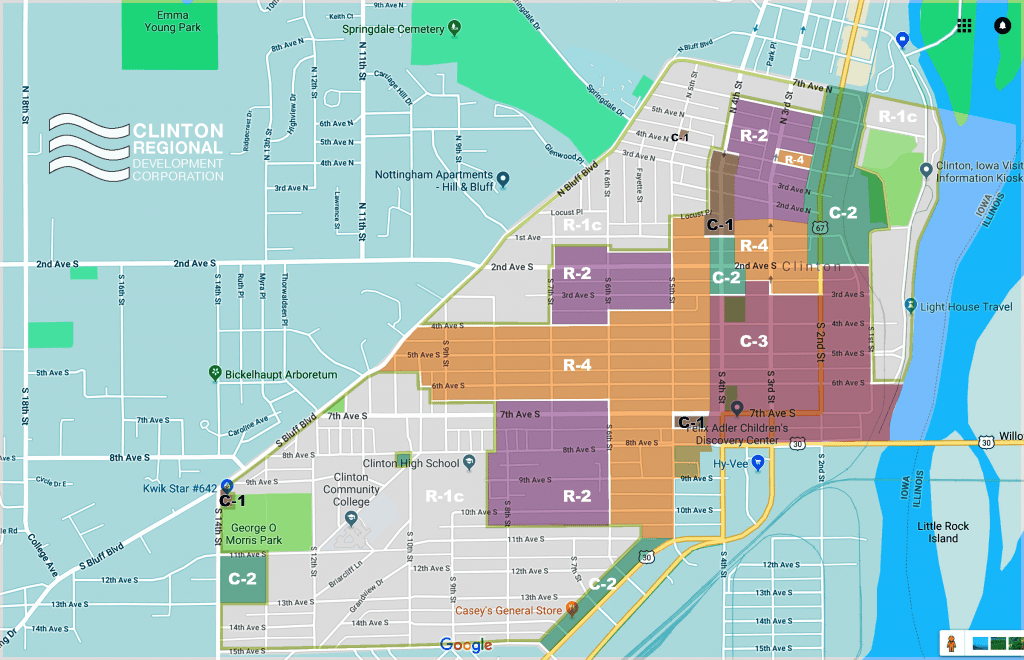

Two contiguous census tracts were certified as Opportunity Zones in Clinton, IA. The map below outlines the tracts and presents the current zoning as defined by the City of Clinton (IA).

The Clinton Regional Development Corporation will be leveraging Opportunity Zones Program to attract new investment and inject wealth into the communities we serve. The CRDC will also be partnering with the Quad Cities First to develop a prospectus focusing on attractive projects identified within the Opportunity Zones.

For more information on the Clinton, IA Opportunity Zones, please email mail@clintondevelopment.com or call (563) 242-4536.

What is an Opportunity Zone?

An Opportunity Zone is an economically-distressed community where new investments, under certain conditions, may be eligible for preferential tax treatment. Localities qualify as Opportunity Zones if they have been nominated for that designation by the state and that nomination has been certified by the Secretary of the U.S. Treasury via his delegation of authority to the Internal Revenue Service.

How do Opportunity Zones spur economic development?

A. Opportunity Zones are designed to spur economic development by providing tax benefits to investors. First, investors can defer tax on any prior gains invested in a Qualified Opportunity Fund (QOF) until the earlier of the date on which the investment in a QOF is sold or exchanged, or December 31, 2026. If the QOF investment is held for longer than 5 years, there is a 10% exclusion of the deferred gain. If held for more than 7 years, the 10% becomes 15%. Second, if the investor holds the investment in the Opportunity Fund for at least ten years, the investor is eligible for an increase in basis of the QOF investment equal to its fair market value on the date that the QOF investment is sold or exchanged.